Integrated circuit industry chain: global manufacturing center turns to China, and domestic test equipment enterprises rise

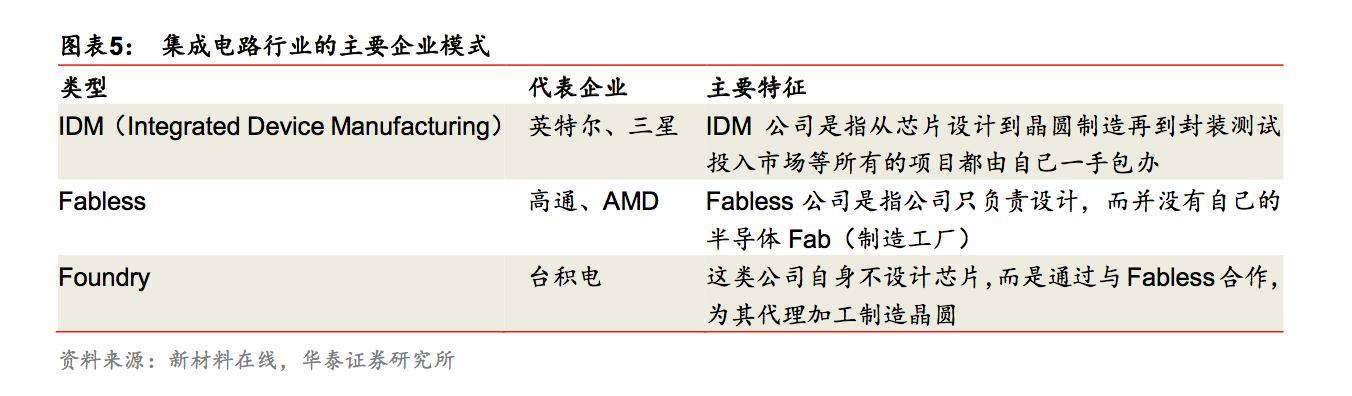

The integrated circuit industry chain began to develop into a vertical division of labor mode of specialization. As the core of the semiconductor industry, integrated circuits have developed rapidly in the past half century. Early integrated circuit enterprises mainly adopted IDM (integrated device manufacturing) mode, which is also called vertical integration mode, that is, IC manufacturers (IDM) designed and sold the finished chips produced, processed, packaged and tested by themselves.

With the increasing maturity of processing technology and the continuous improvement of standardization, the integrated circuit industry chain has begun to develop in the direction of professional division of labor, gradually forming independent chip design enterprises (fabless), wafer manufacturing foundry, package & testing house, and forming a new industrial model - vertical division of labor.

In the vertical division of labor mode, design, manufacturing and packaging testing are separated into an independent link in the integrated circuit industry chain. According to the statistics of the International Semiconductor Association, in terms of the distribution of the global industrial chain, the income from chip design, wafer manufacturing and package testing in 2015 accounted for about 27%, 51% and 22% of the total sales income of the industrial chain.

At present, although most of the top 20 semiconductor manufacturers in the world are still IDM manufacturers, such as Samsung, Intel, Ti, Toshiba, St, etc., in recent years, due to the exponential increase in the research and development cost of semiconductor technology and the investment cost of wafer production line, more IDM manufacturers have started to adopt the Fab Lite mode, that is to say, wafers are manufactured by wafer manufacturers, Even directly become independent chip design enterprises, such as AMD, NXP and Renesas. Vertical division of labor has become the development direction of the semiconductor industry's business model.

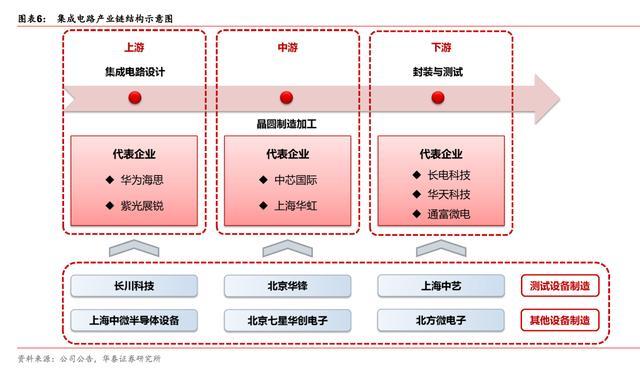

The chip industry chain of China's vertical division of labor has been initially formed. The upstream, middle and downstream of the industry have been connected, and a number of strong representative local enterprises have emerged

Integrated circuit is a basic and leading industry, which involves national information security. Expanding and strengthening the integrated circuit industry has become the strategic leader of national industrial transformation.

In recent years, the gap between China's integrated circuit technology level and the international level has been continuously narrowing, and the industry has entered the track of rapid development, mainly including chip design companies with Huawei Hisense and Ziguang zhanrui as the core, wafer foundry manufacturers represented by SMIC international and Shanghai Huahong, and chip packaging and testing enterprises led by Changdian technology, Huatian technology and Tongfu micro electronics, In addition, it also includes China Resources Microelectronics and Shilan micro which adopt IDM mode.

The completed industrial ecosystem has the foundation to realize the import substitution of special equipment for integrated circuits and solve the large domestic market gap. Baidu searches "Leqing think tank" to obtain more in-depth research reports of the industry

Upstream - integrated circuit design

In recent years, the chip design industry in mainland China has developed rapidly. According to the data of China Semiconductor Industry Association, the income of this segment industry has increased from 27% in 2010 to 37% in 2015. In 2015, the sales volume reached 1325 billion yuan, becoming the fastest-growing field among the three segment industries, which has strongly driven the improvement of chip design level in China.

According to semi statistics, among the top 50 global chip design enterprises (fables) in 2015, mainland enterprises accounted for 9, while in 2009, only one mainland enterprise was shortlisted. Domestic enterprises such as Hisense semiconductor under Huawei and Ziguang zhanrui under Ziguang group have certain global market competitiveness, and Huawei Hisense has entered the top 10 global chip design enterprises. The rise of integrated circuit design enterprises in China has strongly promoted the development of wafer manufacturing enterprises and packaging testing enterprises.

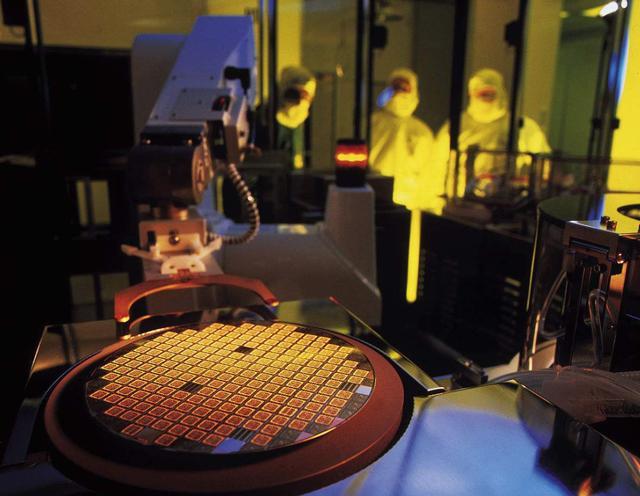

Midstream - wafer manufacturing and processing

Wafer manufacturing belongs to the field of heavy assets and has a high demand for equipment and capital. In order to maintain competitiveness, enterprises spend a high proportion of capital expenditure such as purchasing equipment every year. At the same time, manufacturing enterprises need to constantly catch up with advanced manufacturing processes. Since 1995, the chip manufacturing process has experienced a development process from 0.5 micron to the current 28nm and 16 / 14nm. From 65nm, the investment in wafer manufacturing production line has increased geometrically. With the shrinking of integrated circuit manufacturing nodes, the manufacturing technology difficulty has multiplied, and fewer and fewer manufacturers can follow the process development.

At present, in the field of wafer manufacturing and OEM, the global market is highly concentrated. Semi data shows that the top 10 manufacturers in the world accounted for 91.7% of the global market share in 2015, of which Taiwan integrated circuit manufacturing corporation (TSMC) occupies a monopoly position. Due to the long investment return period of the manufacturing industry, the large amount of capital demand, and the many obstacles that the developed countries and regions impose on the mainland of China in the form of licensing for advanced technologies, only a few enterprises such as SMIC International (SMIC international integrated circuit manufacturing Co., Ltd.) and Shanghai Huahong (Shanghai Huahong Hongli Semiconductor Manufacturing Co., Ltd.) currently occupy a certain market share in the integrated circuit manufacturing field in the mainland of China

Downstream - packaging and testing

Based on China's advantages in terms of cost and proximity to the consumer market, in recent years, global semiconductor manufacturers have successively transferred their seal testing plants to China. For example, Freescale established Freescale Semiconductor (China) Co., Ltd. in Tianjin in 2004 to engage in seal testing and other businesses.

At present, packaging testing has become the most internationally competitive link in China's integrated circuit industry chain. The entry of international advanced technology has led to the continuous improvement of China's sealing and testing technology. At present, the domestic sealing and testing industry is in a situation where foreign-owned enterprises, Sino foreign joint ventures and domestic capital are in a three pronged position. The domestic packaging industry has formed a certain competitiveness. Changdian technology, Huatian technology, Tongfu micro electronics and other domestic enterprises have entered the top 20 global sealing and testing enterprises, and continue to participate in international competition through overseas acquisitions or mergers and acquisitions, Advanced packaging capacity has been greatly improved.

Manufacturing of integrated circuit test equipment

Integrated circuit test equipment manufacturing enterprises throughout the production process are also an important part of the industrial chain. The technical level of integrated circuit test equipment is an important symbol of the progress of integrated circuit test technology. The test equipment has high requirements in test accuracy, test speed, parallel test capability, automation degree and test reliability. As the test link is an important process throughout the production process of integrated circuits, the test equipment manufacturing enterprises also occupy an important position in the industrial chain, which is a strong support for the upstream, middle and downstream enterprises to complete the testing process.

At present, the domestic test equipment market is still dominated by overseas manufacturers, and the market concentration is high. With strong technical and brand advantages, foreign well-known enterprises occupy a leading position in the high-end market. In the face of China's large market demand and relatively low production costs, they have occupied most of the domestic market by establishing wholly-owned enterprises and joint ventures in China. According to the statistics of China Semiconductor Industry Association, in 2015, in the test equipment industry, Teradyne in the United States, ADVANTEST in Japan, Agilent in the United States Xcerra and Cohu account for more than 80% of the domestic market.

A few excellent local test equipment manufacturers are catching up. Among the local enterprises, a small number of special equipment manufacturers in the industry, including Changchuan technology, Shanghai Zhongwei semiconductor, North microelectronics, Qixing electronics and Beijing Huafeng, have mastered relevant core technologies through years of research and development and accumulation, have independent intellectual property rights, have a large scale and a certain brand awareness, and occupy a certain market share. Among them, Changchuan technology The products of the test equipment superiority enterprises represented by Beijing Huafeng have successfully entered the supply chain system of the leading domestic sealing and testing enterprises, and have established a certain market position. Compared with foreign well-known enterprises, domestic competitive enterprises have a better understanding of customer needs, a more flexible service mode, a higher cost-effective product, and a certain local advantage.

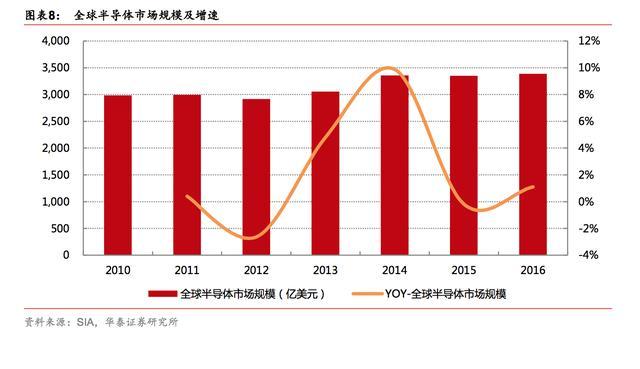

In 2017, the sales of integrated circuits in China may reach 500 billion yuan, and the equipment sales market of 50 billion yuan will be cultivated

In the past three years, the scale of the global semiconductor market has been stable at about 330 billion US dollars. Since 2013, with the gradual recovery of the global economy, the demand for consumer electronic products such as PCs, mobile phones and LCD TVs has been increasing. Meanwhile, driven by the strong demand in emerging application fields such as Internet of things, wearable devices, cloud computing, big data, new energy, medical electronics and security electronics, the global semiconductor sales market grew by 9.9% in 2014, and the sales scale reached 335.8 billion US dollars, From 2015 to 2016, the global semiconductor sales market size was basically the same as that in 2014. According to the prediction of the world semiconductor trade statistics Organization (WSTS), the global semiconductor market size is expected to grow to $346.5 billion in 2017.

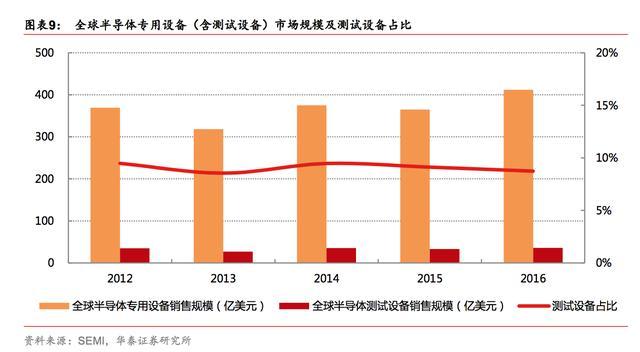

In 2016, the global semiconductor special equipment market has reached more than 40 billion US dollars. The vigorous market demand of integrated circuit drives the continuous upgrading of the industry and the increase of investment, which effectively promotes the development of the integrated circuit equipment manufacturing industry. Therefore, the market of integrated circuit special equipment is closely related to the prosperity of the integrated circuit industry. Since 2014, the global integrated circuit market has started to recover. According to the data of the International Semiconductor Association, the global sales of special semiconductor equipment in 2015 and 2016 reached US $36.5 billion and US $41.2 billion respectively, of which the sales of test equipment were US $3.3 billion and US $3.6 billion respectively.

In 2017, the global semiconductor test equipment market is expected to maintain a scale of $3.5 billion. With the steady growth of the demand of downstream electronics, automobile, communication and other industries, as well as the rapid development of emerging fields such as Internet of things, cloud computing and big data, the integrated circuit industry is facing the demand for capacity expansion of new chips and advanced processes, which brings a broad market space for the integrated circuit special equipment industry including test equipment.

With the reduction of chip size and lines, the demand for test equipment for testing and testing new chips such as FinFETs and 3D NAND is increasing. Due to the reduction of chip size, the corresponding parameter signal will also be weakened, which puts forward higher requirements for test equipment. Semi predicts that the global semiconductor equipment market in 2017 will be US $41.1 billion, of which the test equipment market will be US $3.5 billion.

In 2016, the sales scale of China's integrated circuits has exceeded 400 billion yuan, maintaining a high growth of 20% in the past three years. Although China's integrated circuit market started relatively late, thanks to the strong support of the state for the integrated circuit industry and the accelerating trend of the global integrated circuit industry to China, the development speed of China's integrated circuit industry is obviously faster than the global level. With the gradual improvement of the global economy and the increase of downstream demand, the output of integrated circuits reached 117.04 billion in 2015, with a year-on-year increase of 13.10%, continuing to maintain a leading growth momentum in the global market. From 2011 to 2016, the sales scale of China's integrated circuits increased from 193.3 billion yuan to 433.6 billion yuan, with a compound annual growth rate of 17.5%, and the market growth rate was considerable. In 2015 and 2016, the sales scale of China's integrated circuit industry reached 361 billion yuan and 433.6 billion yuan respectively, with a year-on-year increase of 19.7% and 20.1%. (data in this paragraph are from China Semiconductor Industry Association)

We predict that the sales scale of China's integrated circuits will exceed 500 billion yuan in 2017, and the scale is expected to approach the trillion yuan level in 2020. According to the national integrated circuit industry development promotion program, by 2020, the average annual growth rate of the sales revenue of China's integrated circuit industry will exceed 20%. Driven by the continuous deepening of China's industrialization and information integration, the continuous warming of information consumption, the acceleration of smart city construction and other factors, and with the gradual maturity of cloud computing, big data, Internet of things and other fields, considering that the growth rate in the past three years has remained 20%, and the compound growth rate in the past five years has been 17.5%, As well as the target growth rate of the national integrated circuit industry development promotion outline and the strong promotion of the national integrated circuit industry investment fund, we believe that the sales scale of China's integrated circuit industry is expected to maintain a growth rate of about 20% from 2017 to 2020.

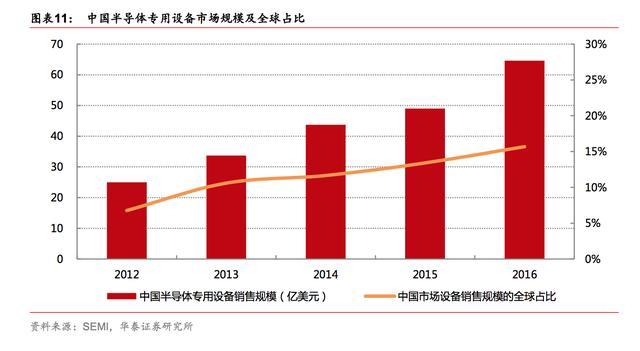

In 2017, the sales scale of China's integrated circuit special equipment is expected to reach 50 billion yuan, and the global share of China's equipment market continues to increase. As the largest country in the world's integrated circuit consumption market, China's integrated circuit industry has been expanding. Meanwhile, with the continuous transfer of international production capacity to the mainland of China, Intel, Samsung and other large international manufacturers have successively invested and built factories in the mainland of China. The mainland of China has a great demand for integrated circuit supporting equipment. From 2012 to 2016, the sales scale of semiconductor special equipment in mainland China increased from US $2.5 billion to US $6.46 billion, accounting for 15.7% of the global market from 6.8%. Semi expects that the market of integrated circuit special equipment in mainland China will continue to grow in the future, and the market scale will reach 7.24 billion US dollars (about 50 billion yuan) in 2017.

Global integrated circuit manufacturing center turns to China, and domestic test equipment enterprises may benefit from the rise of local industries

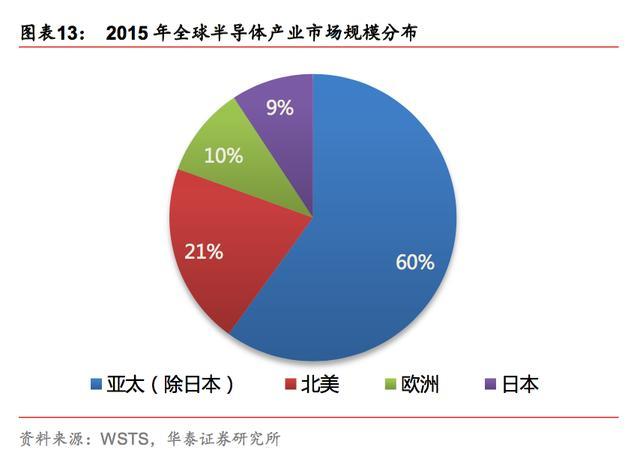

The Asia Pacific region (excluding Japan) with the Chinese market as the core has become the world's largest integrated circuit consumer market, accounting for 60% in 2015 according to WSTS statistics. In terms of regions, the Asia Pacific region (excluding Japan) has become the region with the fastest growth of the global semiconductor market. The compound growth rate reached 9.54% from 2000 to 2015, far higher than the global level of 3.35%. In 2015, the sales volume of the semiconductor market in this region reached us $2011 billion, accounting for 60% of the global market.

The Chinese market has become an important driving force for the development of the Asia Pacific region (excluding Japan), followed by North America (20.51%), Europe (10.22%) and Japan (9.28%). WSTS predicts that the Asia Pacific region (excluding Japan) will continue to maintain stable growth in 2017, and the market size will reach US $207.8 billion.

China has become the world's fastest growing major consumer market for integrated circuits. In the past decade, as the global integrated circuit market has gradually entered a mature development stage, the global industrial growth has slowed down. However, at the same time, with the rapid development of China's economy, China's smart phone, tablet computer, automotive electronics, industrial control, instrumentation, intelligent lighting, smart home and other Internet of things markets have developed rapidly, especially the smart phone and tablet computer markets, China's demand for various integrated circuit products continues to grow. According to WSTS statistics, the consumption scale of China's integrated circuit market in 2000 was only 94.5 billion yuan, and by 2015 it had increased to 1102.4 billion yuan, with an average annual growth of The combined growth rate is as high as 17.80%. In 2015, China's integrated circuit consumption market accounted for more than 50% of the global market

About 70% of China's integrated circuit products depend on imports, and there is a strong demand for localization. Although China's integrated circuit industry has made great progress in recent years, and various sub sectors of the industrial chain have shown rapid development trend, as the world's largest integrated circuit consumer country, China's integrated circuit market still relies heavily on imports. According to the statistics of China Semiconductor Industry Association, the self-sufficiency rate of China's integrated circuit consumer market in 2015 was only 30%, and about 70% relied on imports. The total import volume of integrated circuits has exceeded the import volume of crude oil in the same period, It has become the largest import commodity in China. International advanced enterprises represented by Intel, Samsung and Qualcomm have strong comprehensive strength in technology, products, upstream and downstream and market, and occupy the main share of China's chip market. As the core of the electronic information industry, the import dependence of "China chip" has seriously affected the security of China's information industry, and the domestic demand for chips in China is strong.

The import dependence of special equipment for integrated circuits is also serious. The integrated circuit equipment industry has high technical barriers, market barriers and customer cognitive barriers. Due to the late start of China's integrated circuit special equipment industry as a whole, the scale of the domestic integrated circuit special equipment industry is still small.

According to the data of China Semiconductor Industry Association, in 2015, the sales volume of semiconductor special equipment market in mainland China reached 30.460 billion yuan, of which the sales volume of domestic integrated circuit equipment was only 2.292 billion yuan, and the domestic market share only accounted for 7.5%. The domestic special equipment market is still mainly composed of applied material of the United States, Lam research of the United States, Tokyo electron of Japan, ADVANTEST of Japan It is occupied by foreign well-known enterprises such as KLA Tencor. Special equipment for integrated circuits is an important cornerstone of the development of the integrated circuit industry. A large number of imported special equipment not only seriously affects the development of China's integrated circuit industry, but also causes major hidden dangers to China's electronic information security.

It is the general trend for the global IC production center to shift to China, and the transfer process is accelerating. On the one hand, transferring production capacity to China can better participate in market competition; On the other hand, China has the advantage of low cost and the foundation to undertake capacity transfer. The world's major integrated circuit enterprises, such as Intel, Samsung, global foundries, IBM, ASE, St, Freescale, etc., have successively built factories or OEM plants in China to transfer production capacity to China.

In addition to Intel, Samsung and SK Hynix, which have already set up flags in China and built 12 inch wafer factories in the mainland, SMIC international, Wuhan Xinxin, TSMC, Jinhua integration, Grosvenor and other subsidiaries of Changjiang storage have all set up 12 inch wafer factories in many cities in the mainland. According to the report released by semi, it is estimated that 62 semiconductor wafer factories will be put into production between 2017 and 2020, of which 26 are located in China, accounting for 42% of the global total.

The fastest-growing packaging and testing industry in China is the main demand area for testing equipment. The market demand for testing equipment mainly comes from downstream packaging and testing enterprises, wafer manufacturing enterprises and chip design enterprises, and the packaging and testing enterprises are the main ones. At present, packaging testing has become the most internationally competitive link in China's integrated circuit industry chain. The rapid development of packaging testing industry in China has strongly promoted the market demand for testing equipment.

With the continuous growth of the market demand for domestic integrated circuit products and the continuous promotion of the substitution of domestic chips for imports, the integrated circuit industry will usher in a new round of investment cycle. The local special equipment manufacturers represented by Changchuan technology are expected to fully benefit from the market development space brought by the transfer of integrated circuit capacity.

ADD:Room 1006, Building A, Phoenix Zhigu, Country Garden, xixiang street, Baoan District, Shenzhen

ADD:Room 1006, Building A, Phoenix Zhigu, Country Garden, xixiang street, Baoan District, Shenzhen TEL:0755-83568817 0755-83568867

TEL:0755-83568817 0755-83568867 FAX:0755-83568658

FAX:0755-83568658